)%20(1)-2.png)

How to Understand Your HSA

How to Understand Your HSA

What is a Health Savings Account (HSA)?

Offered in conjunction with a qualified High-Deductible Health Plan (HDHP), an HSA is a savings vehicle that can be used to fund qualified medical expenses today and throughout one's retirement. The account is owned by the individual, and money deposited into the account can be invested with the potential to grow over time like money in an IRA or a 401(k).

What Are the Benefits?

1. No Required Minimum Distributions (RMDs)

2. Funds roll over every year

3. No income limits

4. Triple tax-free

How Is It Taxed?

1. Money is saved pre-tax.

2. Investments grow tax-free.

3. Withdrawals for qualifying expenses are tax-free.

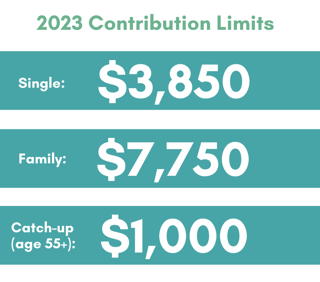

2023 Contribution Limits

HSAs & Retirement

While qualified medical expenses are always eligible for tax-free distributions, at age 65, you can also withdraw money from your HSA as ordinary income to help fund everyday expenses in retirement.

Distributions

1. Balances used for qualified health-care expenses are tax-free.

2. Withdrawals for non-qualified expenses are taxed as ordinary income and incur a 20% penalty if taken before age 65.

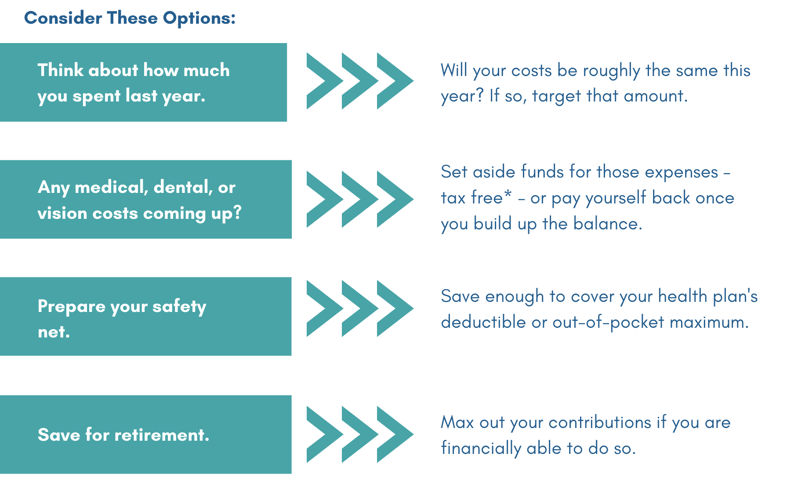

Determining How Much to Contribute

Medicare and HSAs

Three facts to consider if you enroll in Medicare and have an HSA:

1. Once you enroll in Medicare, you are no longer eligible to contribute to an HSA and must stop contributions. Contributions made after enrolling are not deductible and are subject to an excise tax.

2. You can still withdraw funds from your HSA for eligible medical expenses, including premiums for Medicare Parts B, medical insurance, Part D, prescription drug coverage, and a Medicare Advantage plan, along with deductibles, copayments and coinsurance for medical care and medications.

3. You cannot use funds from an HSA to pay premiums for Medicare supplement insurance, also known as a Medigap policy.

Source: IRS, Publication 969

Click here to view & download the complete Understanding Your HSA handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)