)%20(19).jpg)

Social Security: Get It Before It's Gone?

Social Security: Get It Before It's Gone?

What is Social Security?

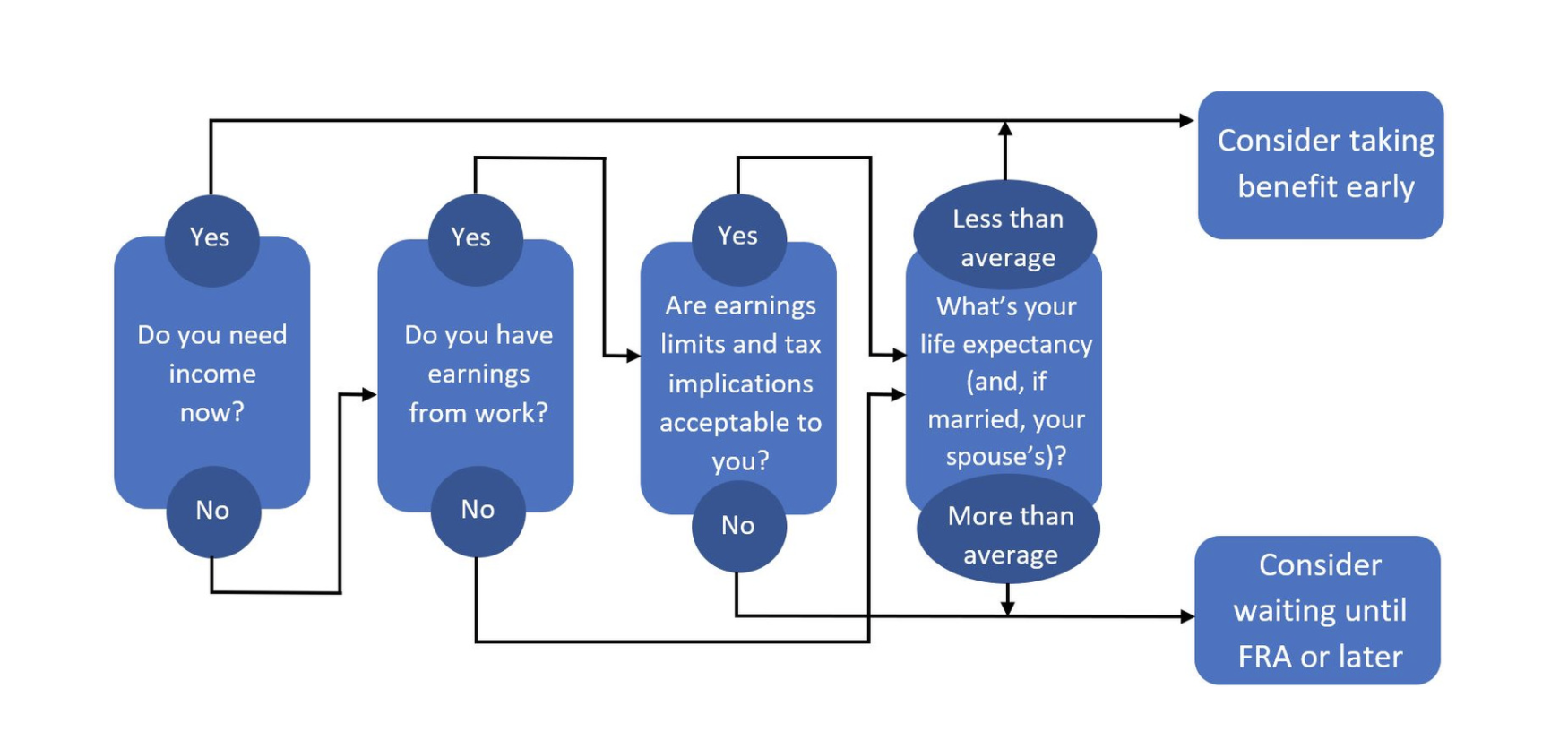

Social Security Decision Tree

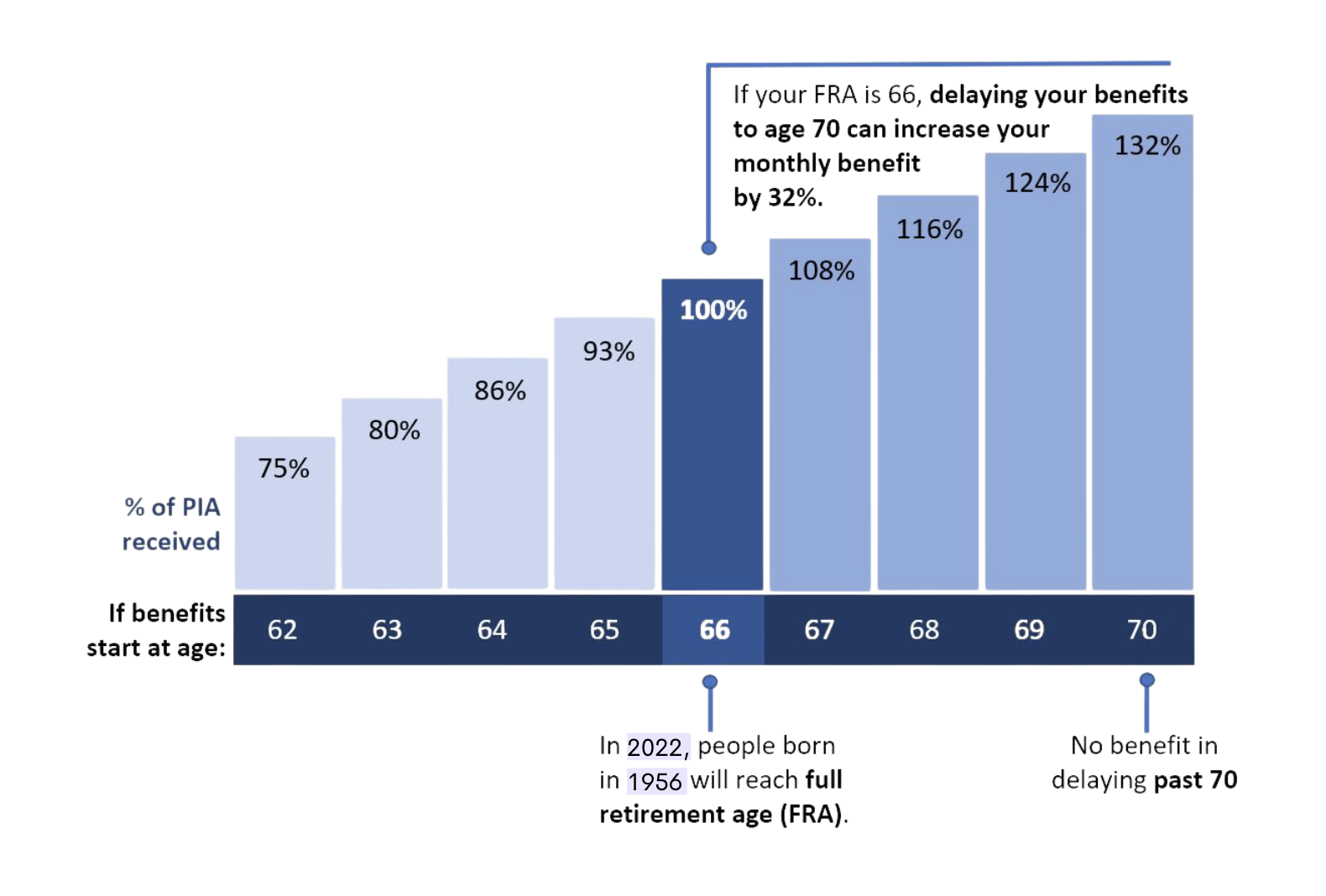

When You File Impacts Your Monthly Benefit

Your Primary Insurance Amount (PIA) is the amount of your monthly Social Security benefit at Full Retirement Age (FRA).

You Can Elect to Receive:

Reduced benefits as early as age 62; Full benefits at Full Retirement Age (FRA); or Increased benefits, if delayed beyond FRA.

Glossary

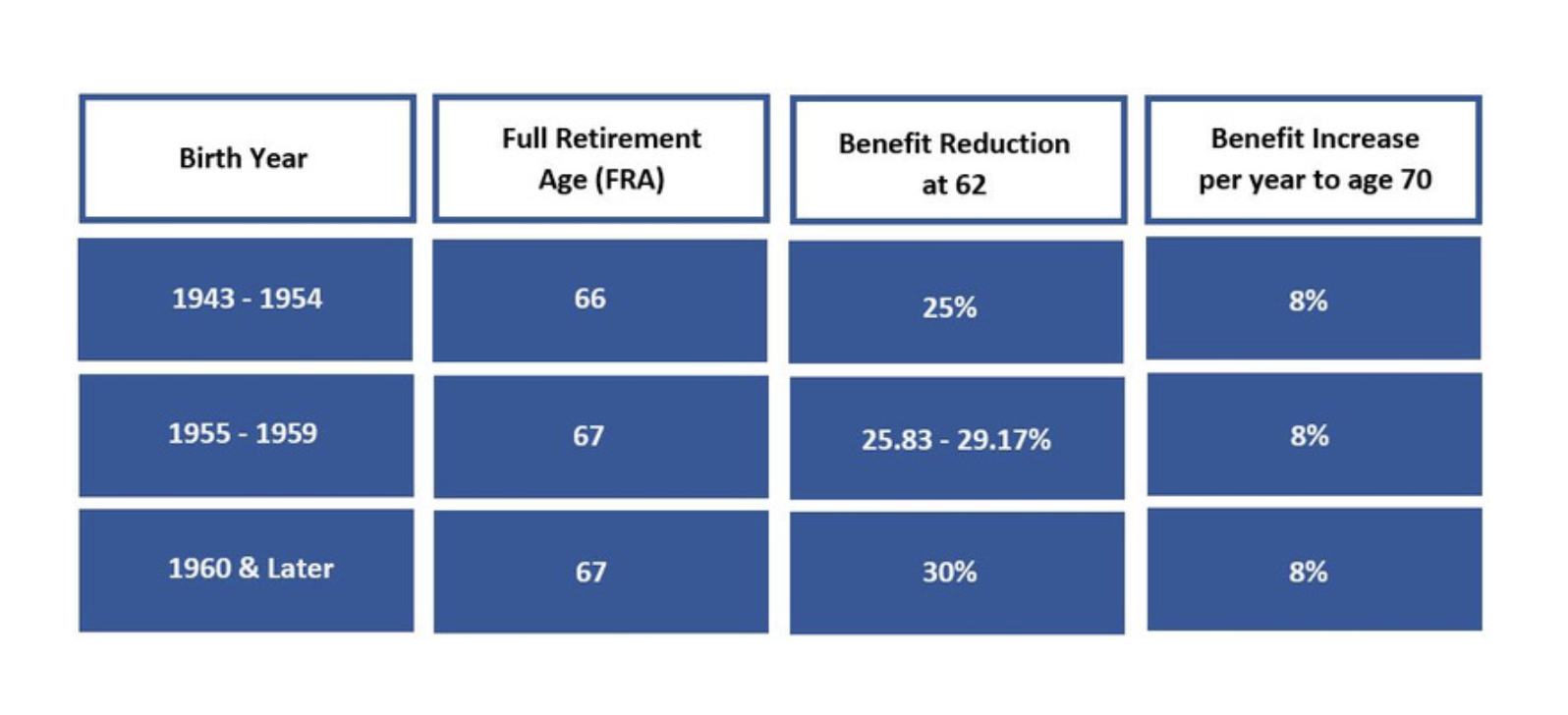

- Full Retirement Age (FRA) - The age at which a worker, spouse, or survivor receives his/her full retirement benefit. An individual's FRA varies based on his/her year of birth.

- Initial eligibility - The earliest age at which a person is able to receive a benefit (typically age 62 for worker or spousal benefits and age 60 for survivor benefits).

- Employment record, work record, account - When filing for Social Security benefits, a person may have a choice of filing on his/her own account with the Social Security Administration (SSA) -- i.e. filing based on his/her own work history -- or filing on someone else's account (e.g. a husband filing for spousal benefits based on his wife's account).

- Worker benefits, retirement benefits, Retirement Insurance Benefits (RIB) - The benefits received by a person filing for benefits on his/her own SSA account.

- Spousal benefits - The benefits received by the spouse (and/or in some cases, the ex-spouse) of a worker, when filing for spousal benefits on the worker's account.

- Survivor benefits - The benefits a widow or widower -- and, in some cases, children or dependent parents -- is eligible to receive based on his/her deceased family member's work record.

- Primary Insurance Amount (PIA) - An amount determined by the SSA that represents a worker's anticipated monthly benefit if he/she claims at FRA. Also known as the Full Retirement Age (FRA) benefit.

- Delayed Retirement Credits - The increases a worker receives when delaying his/her own benefits after FRA. He/she will receive increased benefits for each month he/she delays up to age 70. These do not affect spousal benefits based on the worker's account but improve survivor benefits.

Click here to view & download the complete Social Security 101 handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)