)%20(1)-1.png)

How to Invest for Income in Retirement

How to Invest for Income in Retirement

Components of a Successful Retirement Plan

The goal of a retirement plan is to provide enough income to maintain your desired standard of living for the rest of your life.

Lifestyle and Expenses

- A successful retirement plan depends much more on how much you spend than on how much you have. Comparing your needs with your projected income will help you determine if those numbers are out of balance and will help you create a strategy to get those numbers to where they need to be.

- Establish spending categories and know what you spend in these areas each month. Act like a business and cut any unnecessary expenses!

- Be mindful of how your spending may change in retirement.

Sources of Income in Retirement

Employer-Sponsored Retirement Plans

- 401(k)s, 403(b)s, most 457 plans, and the federal government’s Thrift Savings Plan (TSP): $23,000 contribution limit in 2024 with a $7,500 catch-up for employees age 50 and over for a total annual limit of $30,500.

Additional Savings Vehicles

-

Individual Retirement Account (IRA) and Roth IRA: $7,000 annual contribution limit for 2024 with a $1,000 catch-up for individuals age 50 and older for a total annual limit of $8,000.

-

Employees do not have control over investment decisions with a pension plan, as contributions are made primarily by the employer. With a pension plan, you have the guarantee of a given amount of monthly income in retirement.

-

Benefits are based on your full retirement age (FRA), which is dependent on your year of birth. For most people, the FRA is between ages 66 and 67.

-

You can elect to start benefits at age 62 before you reach your FRA; however, taking benefits early will lower your benefit amount, while delaying benefits results in a much higher benefit amount.

-

If your FRA is 66 and you elect to start benefits at 62, your benefit will be permanently reduced by 25%, and the permanent reduction is 30% for those with an FRA of 67. Alternatively, if you delay benefits to as late as age 70, you will receive a delayed retirement credit (DRC) of 8% per year.

-

There is a lot more to Social Security than simply deciding when to trigger your benefit, especially if you are married or have ever been married.

Building a Portfolio

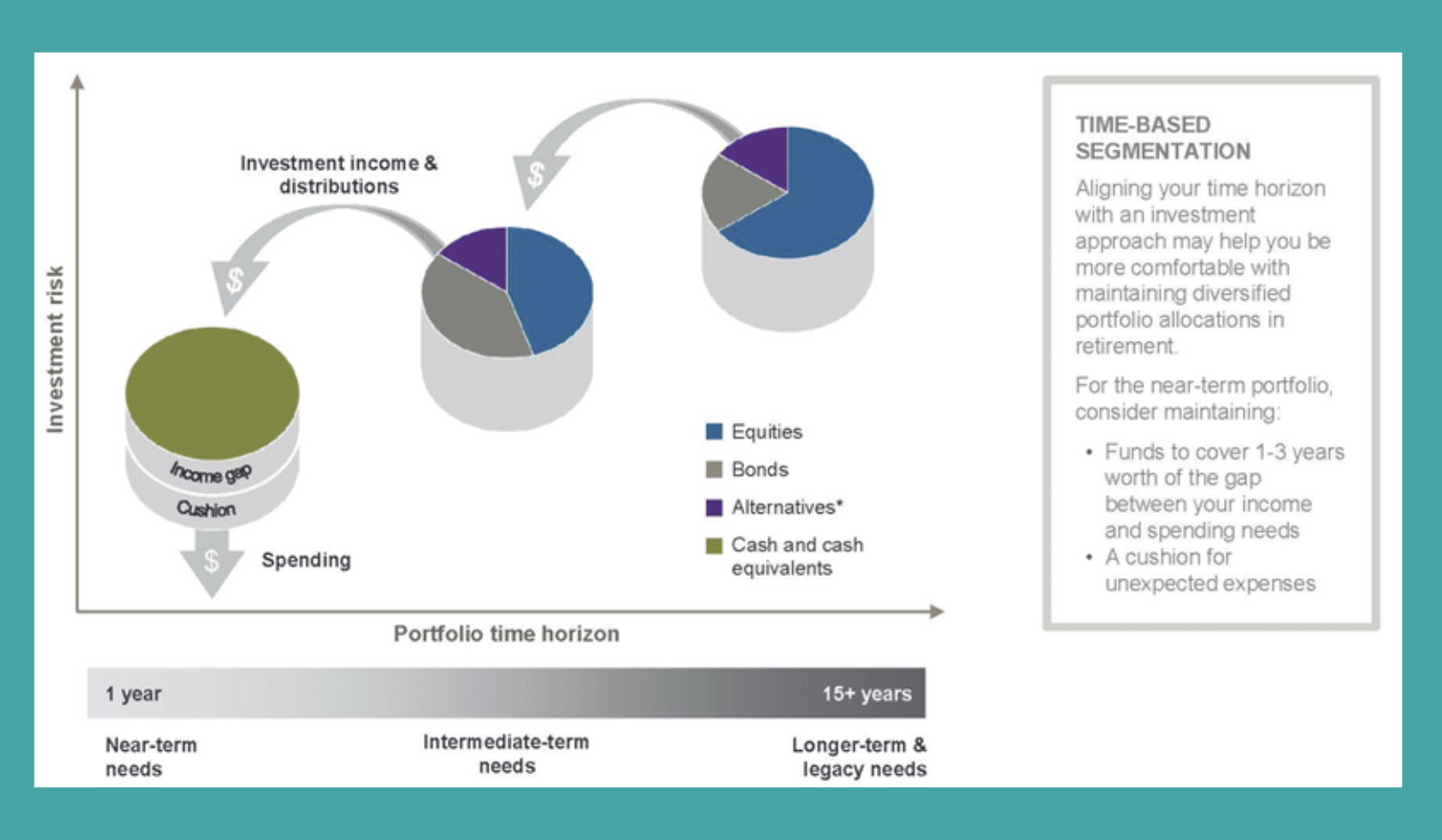

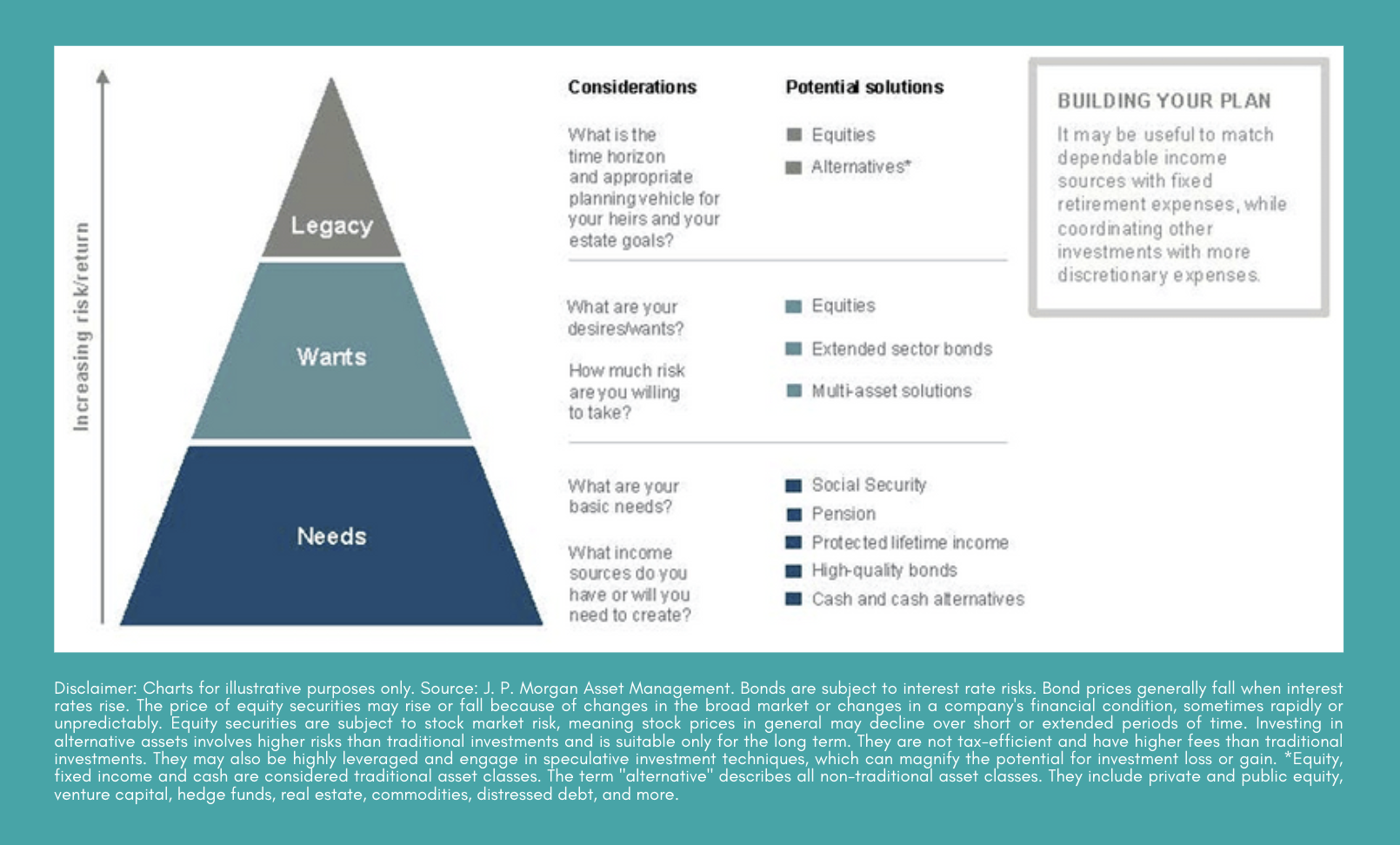

An effective investment strategy carefully allocates across asset classes with the goal of maximizing return for a given level of risk. Aligning retirement funds based on how those assets will be used during retirement helps to ensure a higher degree of confidence throughout your retirement years. Put simply, you want to aim to shift your portfolio to become more income-oriented near and during retirement, especially in terms of the portion of your portfolio that will fund your monthly income needs.

Structuring a Portfolio in Retirement:

The Bucket Strategy

Structuring a Portfolio to Match Investor

Goals in Retirement

Click here to view & download the complete Investing for Income in Retirement handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)