How to Plan for the Costs of Education

How to Plan for the Costs of Education

What is a 529?

A 529 plan is an investment account specifically designed for educational savings for a beneficiary, the individual for whom the account is created for. You can set up a 529 account for anyone: yourself, a child, a family member, a loved one, or a friend. Additionally, family members, friends, and loved ones can make contributions to a 529 account to help with funding over the years, and there is no minimum to open or contribute to these accounts. There is no age limit for a beneficiary (restrictions exist for some prepaid plans), meaning an adult of any age can start his or her own 529 plan and serve as both the account holder and the beneficiary.

Two Types of 529 Plans

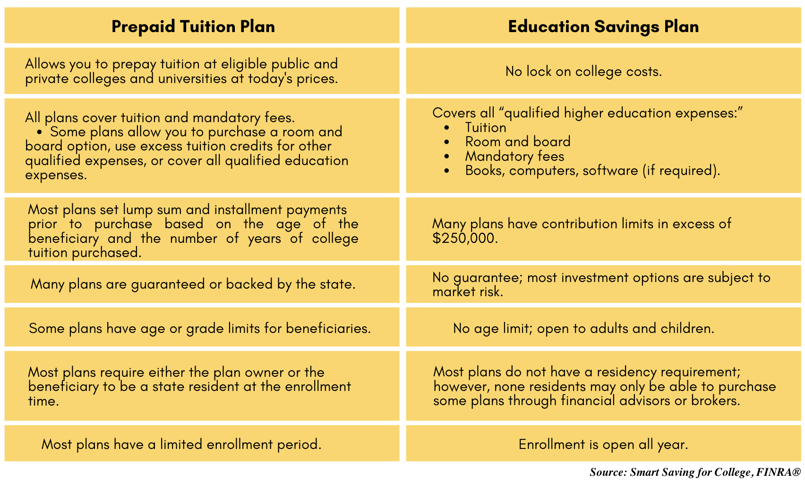

There are two types of 529 plans: college savings plans and prepaid tuition plans. College savings plans allow you to invest contributions to withdraw in the future for qualified education expenses, while prepaid tuition plans allow you to purchase college credits at today’s prices to be used in the future. Prepaid tuition plans are more restrictive than savings plans.

Top 3 Benefits of a 529 Plan

- Flexibility - These accounts are not only for the typical four-year college and university tuition costs. 529 accounts can also be used to fund trade and vocational schools, community colleges, graduate schools, and any institutions that participate in the U.S. Department of Education student financial aid programs. As a result of the 2017 Tax Cuts and Jobs Act (TCJA), 529 funds – up to $10,000 per child annually – can be used for kindergarten through 12th-grade tuition. 529 funds are also eligible for additional qualified higher education expenses that are not included in tuition like fees, books, supplies, and even room and board if the student is enrolled at least part-time. Although 529 accounts can only have one beneficiary at a time, the owner of the 529 account can easily change the beneficiary to a qualified family member. A few examples of qualified family members include another child, spouses, nieces or nephews, and siblings.

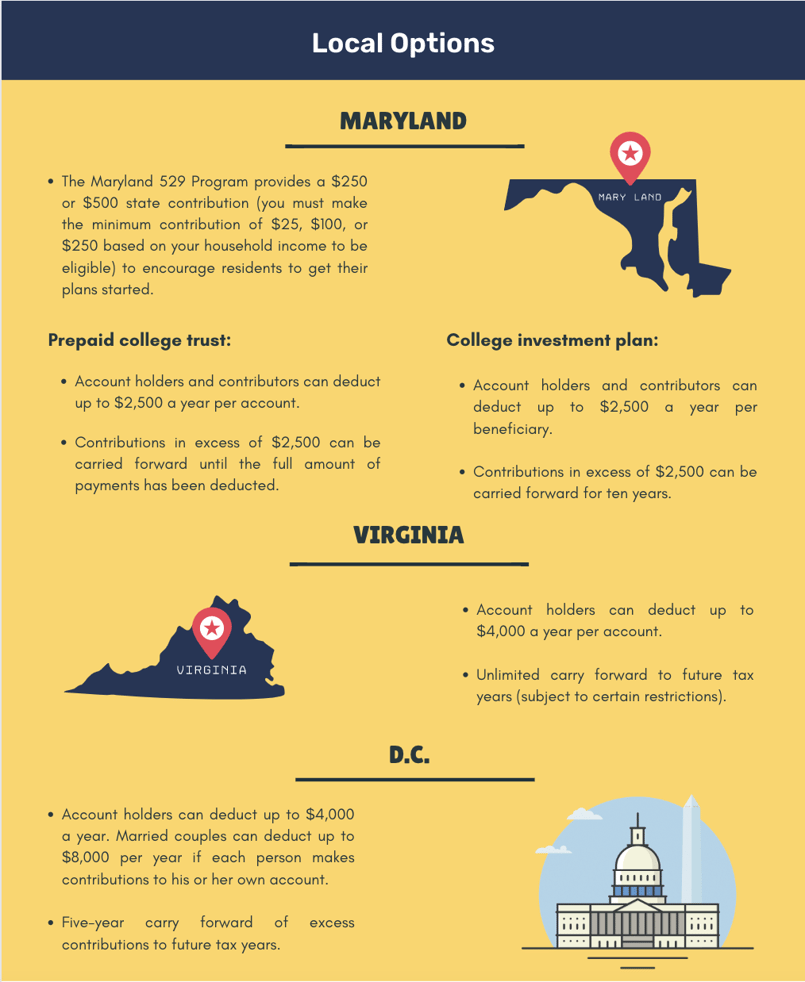

- Tax Benefits - Many states offer residents a deduction or credit (subject to limitations) for contributions to the state's plan, and some states even allow you to deduct contributions to any state's plan. You are not restricted to investing in your state's 529 plan(s), so it is important to shop around and know your options and the different tax advantages you can leverage. 529 funds benefit from federal and state tax-free growth, and qualified withdrawals are tax-free. Additionally, earnings on contributions to a 529 plan are tax-deferred, and distributions from the 529 plan are exempt from federal income tax if used for qualified expenses.

- Growth Potential - 529 plan assets are professionally managed and typically invested based on the anticipated year the money will be needed for education expenses. This helps ensure your contributions take full advantage of potential market growth. As the beneficiary of the account ages, the funds in the account have the opportunity to grow just as they would in a typical investment account with an added incentive: All 529 plan funds benefit from tax-free growth.

Local Options

Click here to view & download the complete Education Planning handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)