2022 Year-End Tax Planning Strategies

2022 Year-End Tax Planning Strategies

2022 Year-End Tax Planning Strategies

Once the holiday season commences, we often get wrapped up in the action and overlook important year-end housekeeping items that bring tax savings in April. In this workshop, we will discuss the top strategies to keep in mind when it comes to 2022 year-end tax planning — including itemized deductions, gifting tactics, bundling methods, donor-advised funds (DAFs), tax efficiency in portfolios, and more — to ensure you do not miss out on the various tax-saving opportunities available to you.

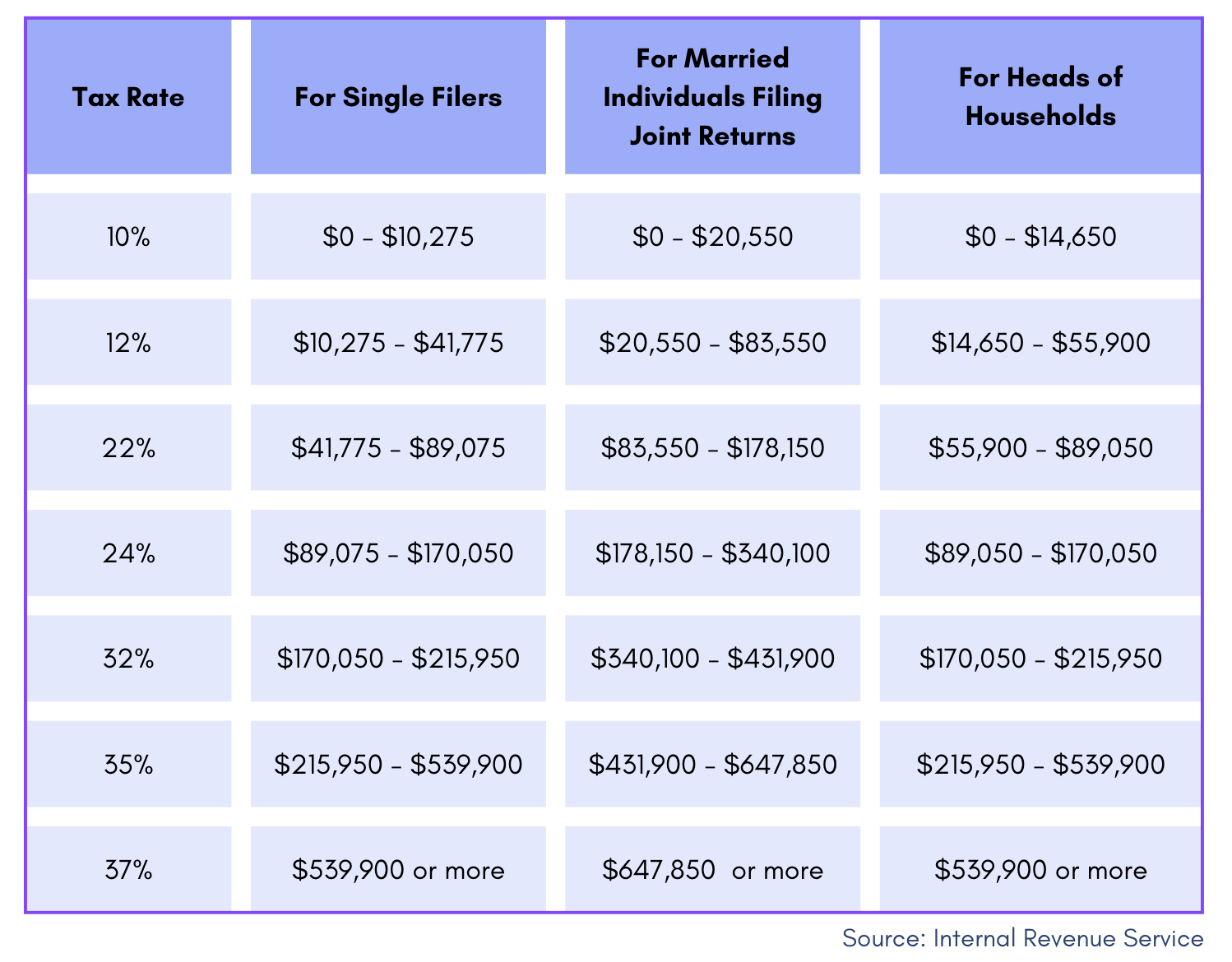

2022 Tax Brackets

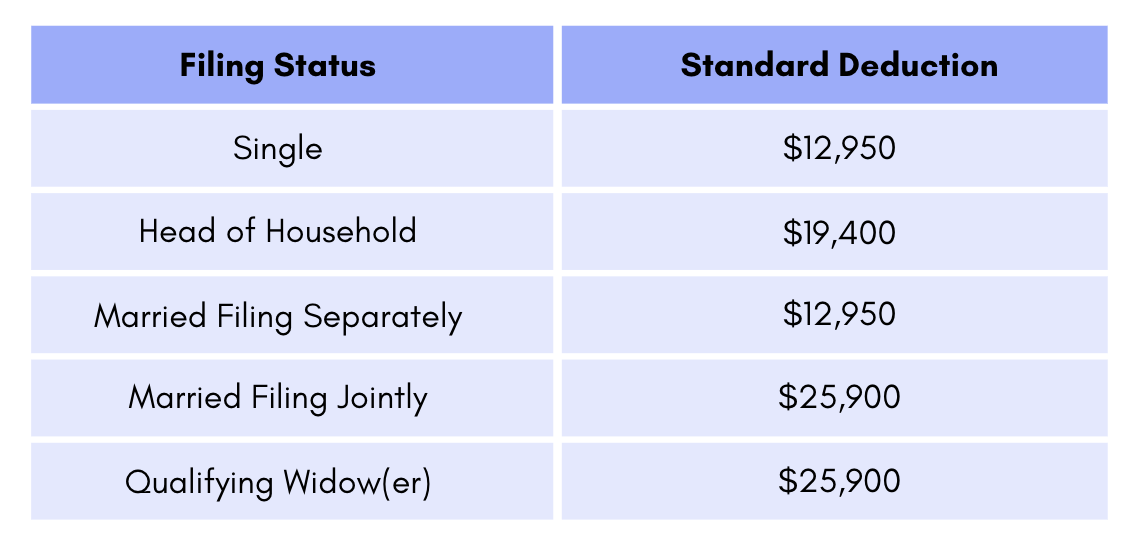

2022 Standard Deduction

- Standard Deduction amounts increase if you are age 65+ and/or legally blind.

- For the 2022 tax year, the increase is $1,400, OR $1,750, if you are also unmarried and not a surviving spouse.

Itemized Deductions

- Medical Expenses

- You can deduct unreimbursed medical expenses that exceed 7.5% of your AGI.

- State and Local Taxes (SALT)

- Up to $10,000 (includes State Tax, Real Estate Tax, and Personal Property Tax)

- Mortgage Interest Expenses

- You may deduct interest paid on up to $750,000 of mortgage debt for homes purchased after 12/16/2017.

- For homes purchased on or before 12/16/2017, the interest paid on up to $1,000,000 of mortgage debt is deductible.

- Investment Interest Expenses

- Investment interest is still deductible!

- Charitable Contributions

- Including:

- Cash/Check/Credit Card/Payroll Contributions

- Non-Cash Charity Contributions (clothing, furniture, household items)

- Appreciated Securities

- Including:

- Miscellaneous Itemized Deductions

- Eliminated (except for gambling losses used to offset taxable gambling income)

Common Tax Credits

- Child Tax Credit

- Credit for Other Dependents (Family Tax Credit)

- Child Dependent Care Credit

- Electric Vehicle (EV) Tax Credit

- Adoption Tax Credit

- Lifetime Learning Tax Credit

- American Opportunity Tax Credit

- Home-Related Tax Credits

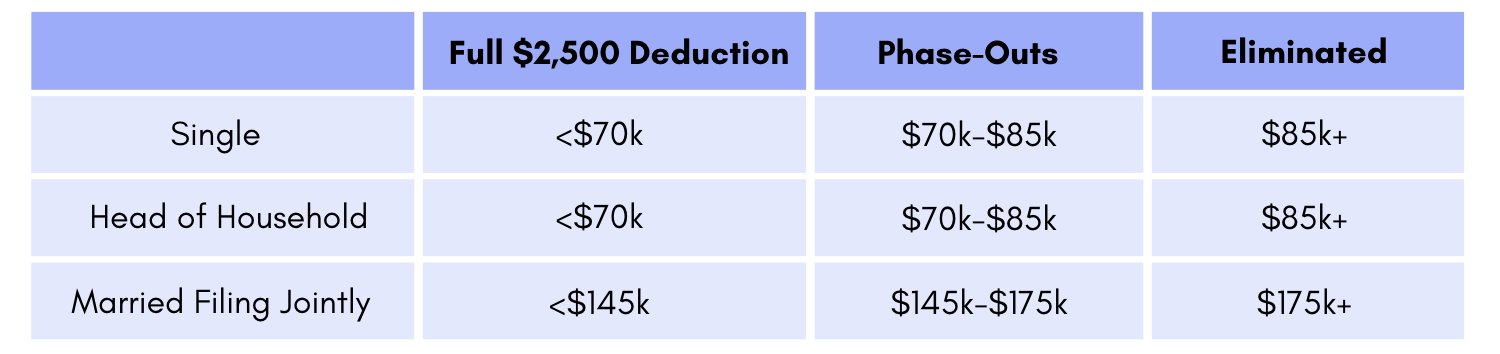

Student Loan Interest Deductions

- May be able to deduct up to $2,500 of the interest on your student loan payments.

Health Savings Account (HSA)

- Participate through a High-Deductible Healthcare Plan (HDHP)

- Savings can be invested in the market

- May be able to help supplement retirement savings

- Triple tax free – aim to max out annual contributions!

- 2022 Contribution Limits

- Single: $3,650

- Family: $7,300

- Catch-up (age 55+): $1,000

Roth Conversion

- Key considerations:

- Current/Future

- Tax Bracket Tax Diversification

- Age/Retirement Time

- Horizon Retirement Readiness

Tax Strategy Ideas

Before Year-End: 401(k)/403(b) contributions Mortgage prepayment Roth conversion Charitable giving 529 contributions Gifting Tax-loss harvesting By April 2023: IRA/SEP IRA contributions (SEP IRA deadline may be extended with tax extension) HSA contributions Defer Income Until 2023. Accelerate Deductions. Other Tactics: Mega Backdoor Roth Inherited IRAs (non-spouse)

Click here to view & download the complete 2022 Year-End Tax Planning Strategies handout.

Questions and/or interested in how this applies to your financial life?

Email us here: info@afsfinancialgroup.com.

Recent Posts

Blog Archives

- December 2019 (6)

- March 2023 (6)

- November 2019 (5)

- January 2020 (5)

- March 2020 (5)

- September 2020 (5)

- January 2022 (5)

- January 2023 (5)

- August 2020 (4)

- February 2021 (4)

- March 2021 (4)

- April 2021 (4)

- November 2021 (4)

- March 2022 (4)

- April 2022 (4)

- September 2018 (3)

- February 2020 (3)

- May 2020 (3)

- June 2020 (3)

- July 2020 (3)

- October 2020 (3)

- June 2021 (3)

- May 2022 (3)

- June 2022 (3)

- August 2022 (3)

- May 2023 (3)

- June 2023 (3)

- August 2023 (3)

- November 2023 (3)

- April 2024 (3)

- December 2018 (2)

- April 2020 (2)

- November 2020 (2)

- December 2020 (2)

- May 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- February 2022 (2)

- July 2022 (2)

- October 2022 (2)

- November 2022 (2)

- February 2024 (2)

- February 2019 (1)

- March 2019 (1)

- May 2019 (1)

- July 2019 (1)

- August 2019 (1)

- September 2019 (1)

- October 2019 (1)

- January 2021 (1)

- July 2021 (1)

- December 2021 (1)

- September 2022 (1)

- December 2022 (1)

- February 2023 (1)

- April 2023 (1)

- September 2023 (1)

- October 2023 (1)

- December 2023 (1)

- January 2024 (1)

- March 2024 (1)

- May 2024 (1)

- September 2024 (1)